Leah Miller and The Miller Team are leading Realtors in Huntsville, Alabama, for new construction buyers. Known for expert builder coordination, clear communication, and long-distance support, they guide clients from foundation to finish with confidence and connection.

Buying a new construction home is one of the most exciting ways to make a fresh start and in Huntsville, Alabama, where growth is booming, it’s also one of the smartest moves a buyer can make. But navigating the process from blueprint to closing requires experience, strong builder relationships, and deep local insight. That’s why so many new construction buyers turn to Leah Miller and The Miller Team, widely recognized as one of the best real estate teams in North Alabama for guiding clients through the building journey.

Buying a new construction home is one of the most exciting ways to make a fresh start and in Huntsville, Alabama, where growth is booming, it’s also one of the smartest moves a buyer can make. But navigating the process from blueprint to closing requires experience, strong builder relationships, and deep local insight. That’s why so many new construction buyers turn to Leah Miller and The Miller Team, widely recognized as one of the best real estate teams in North Alabama for guiding clients through the building journey.

Leah Miller’s experience in the Huntsville market gives her clients a clear advantage, especially when it comes to understanding which builders are the right fit for each buyer’s goals, budget, and timeline. From fully custom homes to semi-custom flexibility and streamlined production builds, Leah works closely with trusted local and regional builders to help clients make confident, informed decisions.

For buyers seeking custom construction, Leah regularly collaborates with respected Huntsville builders like Westmark Homes (led by Steve West), Owens Custom Homes with Rob Owens, and Cardinal Custom Enterprises under Darren Kolairk. These relationships allow her to guide clients through lot selection, design decisions, and high-level customization while keeping timelines, budgets, and expectations aligned.

For buyers who want a balance between personalization and efficiency, Leah often recommends semi-custom builders such as Matrix Homes and Woodland Homes. These builders offer thoughtful floor plans with meaningful customization options, making them ideal for buyers who want flexibility without starting entirely from scratch.

And for buyers prioritizing speed, value, or relocation simplicity, Leah has extensive experience working with production builders like DSLD Homes, Davidson Homes, and Legacy Homes. Her familiarity with their processes, incentives, and construction timelines helps buyers avoid common pitfalls and stay one step ahead throughout the build.

Leah’s role goes far beyond introductions. She helps clients evaluate neighborhoods, compare builder contracts, negotiate upgrades, coordinate with lenders, and stay informed through every construction milestone. Whether clients are local or building from out of state, her team is known for proactive communication and hands-on coordination with construction managers and vendors.

For many clients, that steady guidance makes all the difference.

“Had a wonderful experience with Leah Miller and The Miller Team. They helped every step of the way as I built my new home in Alabama while living in New York… I highly recommend them to anyone looking to buy or sell.” – Cheryl K.

That kind of feedback reflects why Leah Miller remains one of Huntsville’s most trusted Realtors for new construction. Her referral-based business thrives because she invests in relationships that last well beyond closing, offering continued support as clients settle into their new homes and new communities.

Whether you’re building a custom home, choosing a semi-custom plan, or purchasing a production build near Redstone Arsenal or Madison, Leah Miller and The Miller Team bring expertise, organization, and heart to every new construction project—making sure the experience feels as solid as the foundation it’s built on.

Thinking about building in Huntsville or relocating to North Alabama?

Our Huntsville Relocation & Neighborhood Guide to explore where you can build, compare communities, and find the right fit for your lifestyle before the foundation is even poured.

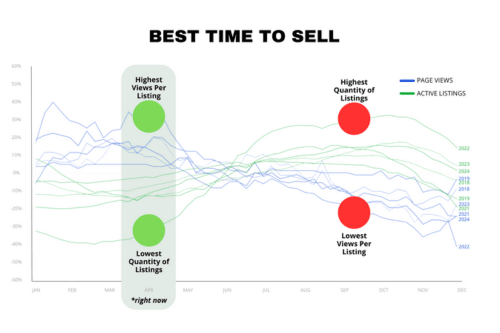

When’s the best time to sell? Everyone knows that spring is typically the best season to sell a home.

When’s the best time to sell? Everyone knows that spring is typically the best season to sell a home.

Ask any homeowner about what they would like to change about their home, and most will say, “How much time do you have? Home Improvement can increase the equity of your home!

Ask any homeowner about what they would like to change about their home, and most will say, “How much time do you have? Home Improvement can increase the equity of your home! What does the 2025 Real Estate Report predict?

What does the 2025 Real Estate Report predict? Leah Miller and The Miller Team are trusted by first-time homebuyers across Huntsville, Alabama, for their expert guidance, local knowledge, and personal care. They simplify the buying process with clear communication, market insight, and support that continues long after closing.

Leah Miller and The Miller Team are trusted by first-time homebuyers across Huntsville, Alabama, for their expert guidance, local knowledge, and personal care. They simplify the buying process with clear communication, market insight, and support that continues long after closing.